Nowadays, online financial transactions are increasing, the use of bank accounts in transactions is inevitable. To grasp that trend, many banks have developed very strongly with accompanying services Bank accounts. So to better understand the above topic, we invite you to follow this article of SeABank to grasp the details.

1. What is a bank account?

A bank account is an asset that the bank provides to customers for use in payments, savings and other financial activities.

Bank account information includes:

- Account name.

- Account number (6-15 digits).

- Account balance.

- Transaction information.

2. Types of bank accounts today.

Bank accounts include: Checking Account, Savings Account, Credit Card Account and Loan Account.

Each type of account is suitable for different purposes.

Payment account: Is the type of account used for the purpose of "Pay" such as: Receiving salary, receiving money, transactions, buying and selling, living expenses... The money in this account is used to make transactions such as: Depositing, withdrawing cash, transferring internally or to other banks, paying bills... If the balance is left in the account, the customer will receive non-term interest.

This account can be linked and used through domestic debit cards, international debit cards (Visa, Mastercard...).

Savings account: This is an account used for interest-bearing purposes and not for payment purposes. Typical transactions of this account are: Depositing and withdrawing savings, using savings accounts as collateral, and transferring ownership of savings. The interest rate of a savings account is determined based on the term of the deposit and depends on the interest rate of each bank.

Savings account for earning interest

Credit card account: This is the type of account used when a customer is granted “Credit card limit” allows customers to make transactions even when there is no money in the account/card. The amount spent must not exceed the limit granted on each card and must be paid when the statement is due. If the payment is overdue, customers will be charged interest according to the interest rate prescribed by each bank.

Loan account:Is the type of account used for the purpose of "Borrowing capital", when disbursing, the bank will open a loan account for the customer. This account helps the customer manage the loan and track the repayment schedule. In addition, businesses can use this account number to look up their loan and repay on time.

3. Two ways to check your business bank account.

Currently there areHere are some ways to check your business bank account that you can refer to:

3.1 Check your business account directly at the counter.

Customers check their accounts at the counter.

OnlyOnly those whose names are on the business account such as: Director, Chief Accountant... can check the account information directly at the bank counter. Because when coming to the bank, these people must bring the Passport, CCCD/ID card of the account holder to verify their identity to ensure confidentiality and information security for the business.

The procedure for checking bank accounts at the counter includes the following steps:

Step 1: Queue up to get a number and wait for your turn to make a transaction.

Step 2: The customer requests the bank staff to check the bank account of his business. At this time, the staff will ask the customer to present the relevant documents, then provide detailed instructions on the procedures and processes for checking the account and provide the necessary forms to fill in the information.

Step 3: Fill in the information on the form according to the instructions of the bank staff.

Step 4: Check the information provided by the bank about the business's bank account. If there are any errors, ask the bank staff to check again. Otherwise, at this step, you will end the transaction.

However, this form of checking will take a lot of time for traveling and waiting for a queue number, which is not suitable for customers who are too busy. Therefore, you can check your bank account through the Electronic Banking system below.

3.2 Check business account via e-Banking

When a business registers for the bank's e-Banking services including Internet Banking and Mobile Banking, it does not take much time to check its account. You can check at any time, any time, including weekends and holidays, and only need a few steps to do it:

Step 1:Access to SeANet/SeAMobile Biz mobile banking application.

Step 2: SeAnet Login/We Are SeAMobile by entering your username and password.

Step 3: Customers select the "Account" section, the system will display information about account types and balances of their business.

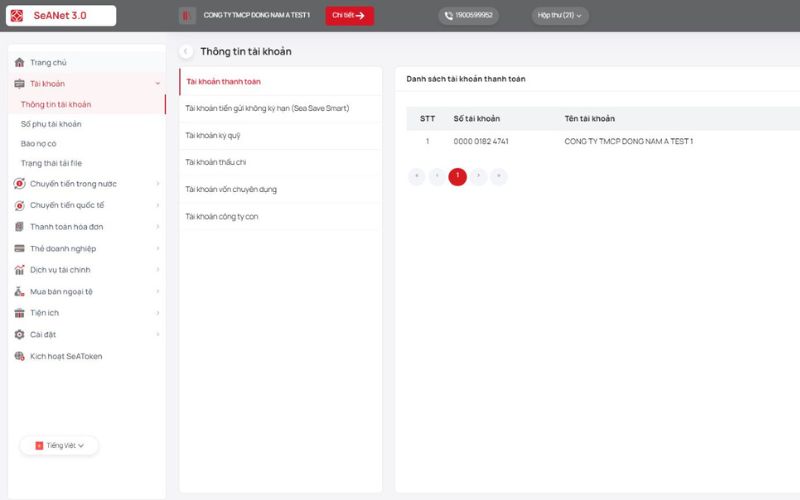

Instructions for checking bank accounts on SeABank on SeANet:

Check accountSeABankat SeANet

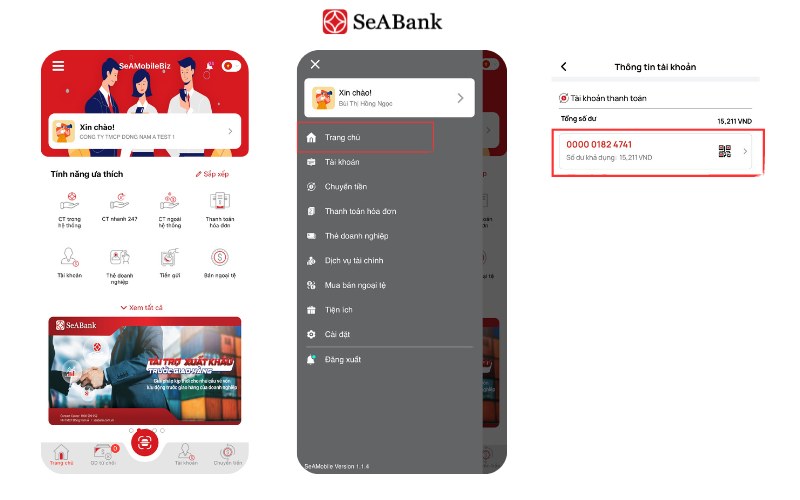

Instructions for checking bank accounts on SeABank on SeAMobile Biz:

Check accountSeABankat SeAMobile Biz Application

4. Conclusion

In the current credit institution system in Vietnam, SeABank is one of the banks that provides a wide range of products and services for corporate customers, with prestige and high security. Open options Business bank accounts at SeABank help customers feel secure in transactions with many utilities, a variety of different types of accounts to help customers manage their finances effectively and optimally.

Above is an article about Bank Accounts and instructions on how to check a business's bank account. With the benefits that a bank account brings, hopefully with the above article, customers have grasped the most basic information. To learn more about this product of SeABank, please visit the website: sme.seabank.com.vn or contact Hotline 1900.599.952 (Business Customer).

See also: What is a business account? How to open a bank account online

See also: Instructions for opening a business account online at SeABank