News

What is CIC? 3 Ways to Check Personal Credit History

31/10/2025

Learn about CIC, how to look up, improve credit score and manage bad debt to borrow capital and open credit cards safely and effectively

In the modern economy, managing and monitoring personal credit has become extremely important. CIC is a system that helps banks, credit institutions and borrowers track credit history, credit scores and bad debt status. Mastering CIC information not only helps you avoid loan risks and improve your credit reputation, but also supports smart and effective personal financial management.

Quick summary:

CIC stands for the National Credit Information Center of Vietnam (Credit Information Center), under the State Bank of Vietnam. CIC is a system that collects and manages the entire credit history of individuals and organizations, thereby providing data for financial institutions to assess the risk and reputation of customers when borrowing capital.

3 easy ways to check CIC include:

- Check on website cic.gov.vn

- Check on the CIC Credit Connect mobile app released by CIC

- Check at the bank counter

1. Overview of CIC

1.1. Concept

According to Article 1 Circular 15/2023/TT-NHNN, CIC (abbreviation of Credit Information Center - National Credit Information Center of Vietnam) is a unit under the State Bank of Vietnam, with the function of collecting, storing, analyzing and providing credit information of individuals and organizations.

Simply put, CIC is a "national credit database", a system that records the entire borrowing and repayment history of people at banks, financial companies, and credit institutions nationwide.

CIC maintains various types of data related to a borrower's credit history, including:

- Identification information about the borrower: Full name, ID card, date of birth, address, occupation,...

- Loan Information: Contract number, limit, outstanding debt, term, loan purpose, etc.

- Payment history: On-time or late payment status, number of overdue days, remaining balance, etc.

- Security Information: Mortgaged assets, guarantor (if any).

- Personal credit score: shows the borrower's reputation and ability to repay.

1.2. Function

CIC plays an important role in the Vietnamese financial and banking system with the following main functions:

- Collecting and storing credit information: CIC synthesizes data from banks, financial companies, and credit institutions to form a unified credit profile for each individual and business.

- Credit analysis and reporting: Based on the collected data, CIC provides reports and credit scores to help financial institutions assess risk before granting credit.

- Risk management support for banks: Through CIC information, banks can detect customers with bad debt, borrowing from too many places or showing signs of fraud, thereby making safer lending decisions.

- Contribute to transparency of financial markets: CIC helps prevent overlapping loans, black credit and creates a transparent and sustainable credit environment for the economy.

1.3. Method of operation

CIC operates based on the following 3-step process:

- Step 1 - Collect credit information: CIC receives data from credit institutions such as banks, finance companies, and other lending institutions.

- Step 2 - Credit Scoring: Based on the information collected, CIC will score your credit.

- Step 3 - Provide credit information: Financial institutions and banks will look up your credit score when you need a loan.

2. Credit scores and debt classification

Credit score is an indicator of the financial reputation and debt repayment ability of an individual or organization. CIC uses its own algorithm to evaluate credit score, based on many factors such as:

- Payment history

- Amount owed

- Time to open a credit account

- Types of credit

- New credit account

In Vietnam, CIC evaluates credit scores on a scale from 150 to 750. The higher the score, the better the financial creditworthiness, thereby giving customers the possibility of being approved for loans with higher preferential interest rates. Specifically:

Credit scores are formed based on many factors, including payment history, number of delinquencies, current outstanding balance, number of loans outstanding, and frequency of recent CIC checks. CIC uses debt classification according to Circular 11/2021/TT-NHNN to evaluate the credit history of customers. Readers can refer to the following:

Classification table of 5 debt groups according to Circular 11/2021/TT-NHNN

If you are classified in group 3 - group 5 (classified as bad debt), you will have difficulty borrowing capital, opening credit cards or accessing other financial products at the bank. Therefore, regularly checking bad debt on CIC is an important step to help you proactively manage your personal finances, maintain credit reputation and increase your chances of accessing capital in the future.

3. Instructions on 3 easy and detailed ways to look up personal CIC

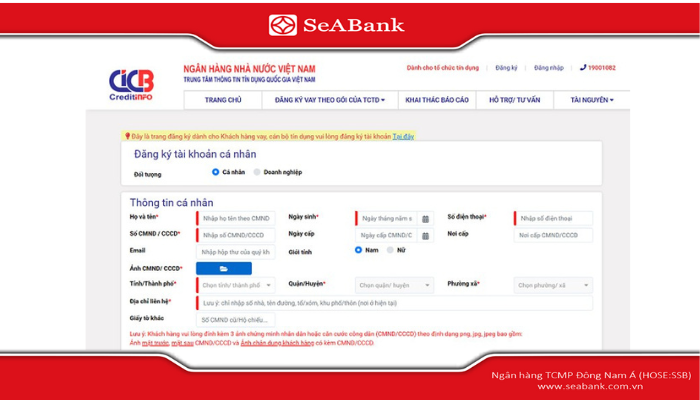

3.1. Look up via CIC website

Here is the 4-step process to look up CIC through the official website

- Step 1:AccessCIC official website: https://cic.gov.vn

- Step 2:Select item“Register / Login”personal account. If you do not have an account, click"Register", then fill in all personal information including:

- Full name, ID card number/CCCD number

- Date of birth, address

- Phone number, email to receive verification code (OTP)

- Step 3:Verify information according to instructions (via photo ID card/CCCD and portrait photo).

- Step 4:Once your account is approved, log in and select the item “Mining personal credit reports”→ The system will display detailed report includes: credit score, debt group, payment history, and current outstanding balance.

Note: Each individual can look up for free once a year via the CIC website.

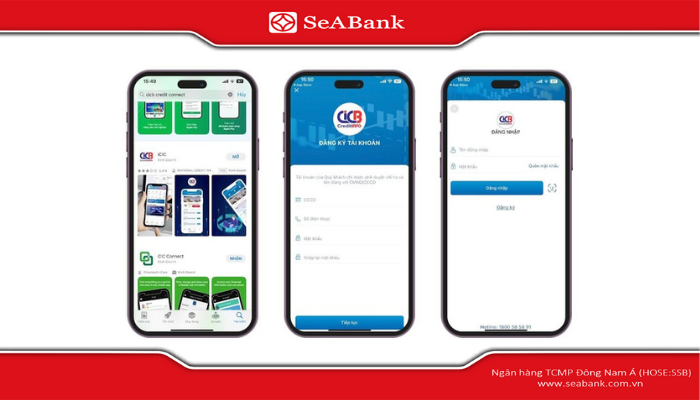

3.2. Look up via CIC Connect application

Besides searching on the website, you can lookup through mobile applications CIC Connect Developed by CIC. CIC Connect application can check anytime, anywhere with just your phone.

- Step 1: Download the “CIC Credit Connect” app on the App Store (iOS) or Google Play (Android). The exact app is published by CIC IT.

- Step 2: Register an account with ID card/CCCD and phone number similar to when creating an account on the website.

- Step 3: After logging in, select “My Credit Information” to view your credit score, bad debt history, remaining balance, and current debt group.

3.3. Check CIC at bank counter

If you are not familiar with the Internet, you can contact the staff at the transaction offices for direct support. You just need to bring your ID card/CCCD and fill out the credit information lookup request form, the bank staff will support you in accessing the CIC system and printing your personal credit report.

4. 4+ Tips to improve credit score and clear bad debt CIC

If you have a history of late payments, past due debt, or a low credit score, don’t worry — it’s possible to improve and restore your credit profile over time. Here are some simple yet effective tips to help you improve your credit score and clear your bad debt on CIC faster:

- Pay off overdue debts: This is the most important step. Please pay all outstanding principal and interest for the bank to update the status as “paid”. After payment, CIC will record and improve the credit score gradually over time.

- Maintain a history of consistent on-time payments: Make timely payments for at least 12 consecutive months to demonstrate financial stability. A good history helps your credit score recover faster and reduces the risk of being classified as a bad debt.

- Don't open too many credit cards or loans at once: Applying for a loan or opening multiple cards in a short period of time will make CIC assess that you have a high demand for loans – a big financial risk, leading to a decrease in your credit score. You should only maintain 1-2 main credit accounts for easy management.

- Regularly check CIC for errors: In many cases, bad debt information is still displayed even though the customer has paid, due to data update errors. Therefore, you should check CIC periodically every 3-6 months to detect errors and send correction requests if necessary.

Beware of "CIC bad debt deletion" service: CIC does not provide any bad debt clearing services, because the data is automatically stored in the State Bank system. Advertisements for “quick bad debt clearing, credit score improvement” are actually scams that can cause you to lose money and expose your personal information. Only by paying off the debt in full and waiting for the system to update can your credit record return to good status.

5. Refer to reputable consumer loan products at SeABank

If you are in need of a loan for personal expenses, shopping, traveling or solving unexpected financial needs, consumer loan products at SeABank are a solution worth considering. The bank offers a variety of loan packages with quick processes, simple procedures and competitive interest rates.

Advantages of consumer loans at SeABank

- Fast approval: Applications are approved within 24-48 hours, with quick disbursement to help you promptly meet your financial needs.

- Flexible loan limit: Limit up to hundreds of millions of dong, depending on the customer's income and financial capacity.

- Simple and transparent procedures: Compact profile, clear process, easy to implement even for first-time borrowers.

- Competitive interest rates: Many attractive interest rate incentive programs, suitable for many customer groups.

- Safety and security: Customer information is absolutely protected according to banking standards.

Interested readers can learn more about consumer loan products at SeABank such as:

6. FAQs

1. Can I check someone else's CIC?

No. CIC is private credit information, kept confidential according to the regulations of the State Bank. Only the information subject or legally authorized credit institution is allowed to look it up. Arbitrarily checking another person's CIC is against the law.

2. Is there a fee for CIC lookup?

- Search online on CIC website: Free once a year for individuals.

- Check at the bank or via the app: Depending on the bank, there may be a small fee as prescribed.

3. How often does CIC update information?

CIC updates data from banks and credit institutions monthly or for each transaction. Usually, after you pay off the loan, the system will update within 1-2 months.

4. Does bad debt affect visa application?

Maybe. Some countries or embassies require financial transparency when considering visas. If you have bad debts or a poor credit history, the bank/embassy may consider you a financial risk, affecting the approval of your application.

Understanding and using information from CIC properly will help you manage your personal finances effectively, be proactive in borrowing capital and avoid bad debt risks. Regularly checking CIC, making payments on time and maintaining a positive credit history are important steps to improve your credit score and access more favorable financial products in the future. Consider CIC as a reliable personal financial management tool to build a sustainable credit reputation.

If you want to learn more about SeABank's card products, you can contact the nearest transaction point or call Hotline 1900 555 587 or visit the website www.seabank.com.vn for more details.