News

SeABank adjusts Senior Management to accelerate transformation toward Retail Banking business model

27/01/2026

Hanoi, January 27, 2026 – The Board of Directors of Southeast Asia Commercial Joint Stock Bank (SeABank, HOSE: SSB) has issued a Resolution regarding changes in senior management personnel, aiming to allocate resources to key strategic projects. Accordingly, Mr. Le Thanh Hai will step down from his role as Deputy CEO to officially assume the position of Head of the Transformation Committee. The establishment of the Transformation Committee, under the leadership of an experienced senior personnel, affirms SeABank’s determination to restructure its business model and meet increasingly stringent sustainable development (ESG) requirements in the new era. This move also aligns with the Bank’s roadmap towards its goal of becoming the most favored retail bank in Vietnam.

Business Model Transformation for Sustainable Growth

As Head of the Transformation Committee, Mr. Le Thanh Hai will be directly responsible for:

- Developing transformation roadmap: Conducting research, analysis, and proposing optimal business and operating models that are fully aligned with the Bank’s long-term development strategy.

- Integrating ESG standards: Embedding Environmental, Social, and Governance (ESG) practices into the core of operational processes, thereby optimizing business performance while generating positive value for the community and the environment.

- Enhancing adaptability: Ensuring a flexible and transparent operating system that fully complies with international standards on risk management and sustainable development.

- Driving digital breakthroughs in Retail Banking: Focusing on optimizing experience for retail banking customers through the application of advanced digital technologies across financial products and services.

Business model transformation: A lever for long-term value creation

In recent years, SeABank has consistently pursued operational and governance practices in line with sustainable development. This adjustment of senior management is a part of the Bank’s roadmap to strengthen transformation management capabilities, closely aligned with its retail banking model development strategy, especially the digital transformation of Retail Banking segment, which will be implemented in strict adherence to the ESG (Environmental, Social, and Governance) framework that SeABank is pursuing:

- Environment (E): The new business model aims to minimize negative environmental impacts arising from operations while promoting shared prosperity through responsible financial products. The acceleration of digital banking helps significantly reduce paper-based processes, supporting the goal of achieving “Net Zero” in operations. Reducing reliance on physical branch networks through mobile banking also contributes to lower energy consumption (electricity, air conditioning) and reduced emissions from customers’ travel activities.

- Social (S): The business model transformation optimizes operational processes, reduces service fees, enables personalized financial products and effective financial management while enhancing financial access for all customer segments through convenient digital platforms.

- Governance (G): Standardizing the business model toward lean and efficient operations, enhancing data transparency, and optimizing risk management processes through the application of smart technologies.

The establishment of the Transformation Committee, directly led by the Bank’s BOD, further demonstrates SeABank’s determination to execute its development strategy built on 5 key pillars, with Retail Banking and Technology as top priorities. This reflects the Bank’s commitment to allocate maximum resources to achieve a breakthrough in the digitalization of personal financial services, while strictly complying with global risk management standards and the ESG framework. This move once again highlights SeABank’s agility and long-term vision in optimizing its business model and organizational structure, ensuring readiness to seize opportunities and address challenges in the digital finance era.

Related News

SeABank reports balanced growth, pre-tax profit reaches nearly VND6.9 trillion in 2025 23/01/2026

SeABank donates nearly VND6.2 billion to support recovery and reconstruction after storms and floods 20/01/2026

SeABank Launches 2026 Lunar New Year Promotion & Celebrates Its 32nd Anniversary for Individual Customers 19/01/2026

Two prestigious awards recognize SeABank's sustainable development strategy 19/01/2026

SeABank affirms its social responsibility at the Vietnam ESG Awards and Trusted Brand Vietnam 2025 30/12/2025

SeABank reports balanced growth, pre-tax profit reaches nearly VND6.9 trillion in 2025

Vietnam’s Southeast Asia Commercial Joint Stock Bank (SeABank) announced its 2025 business results, reporting balanced growth in both scale and efficiency.

23/01/2026

Read more

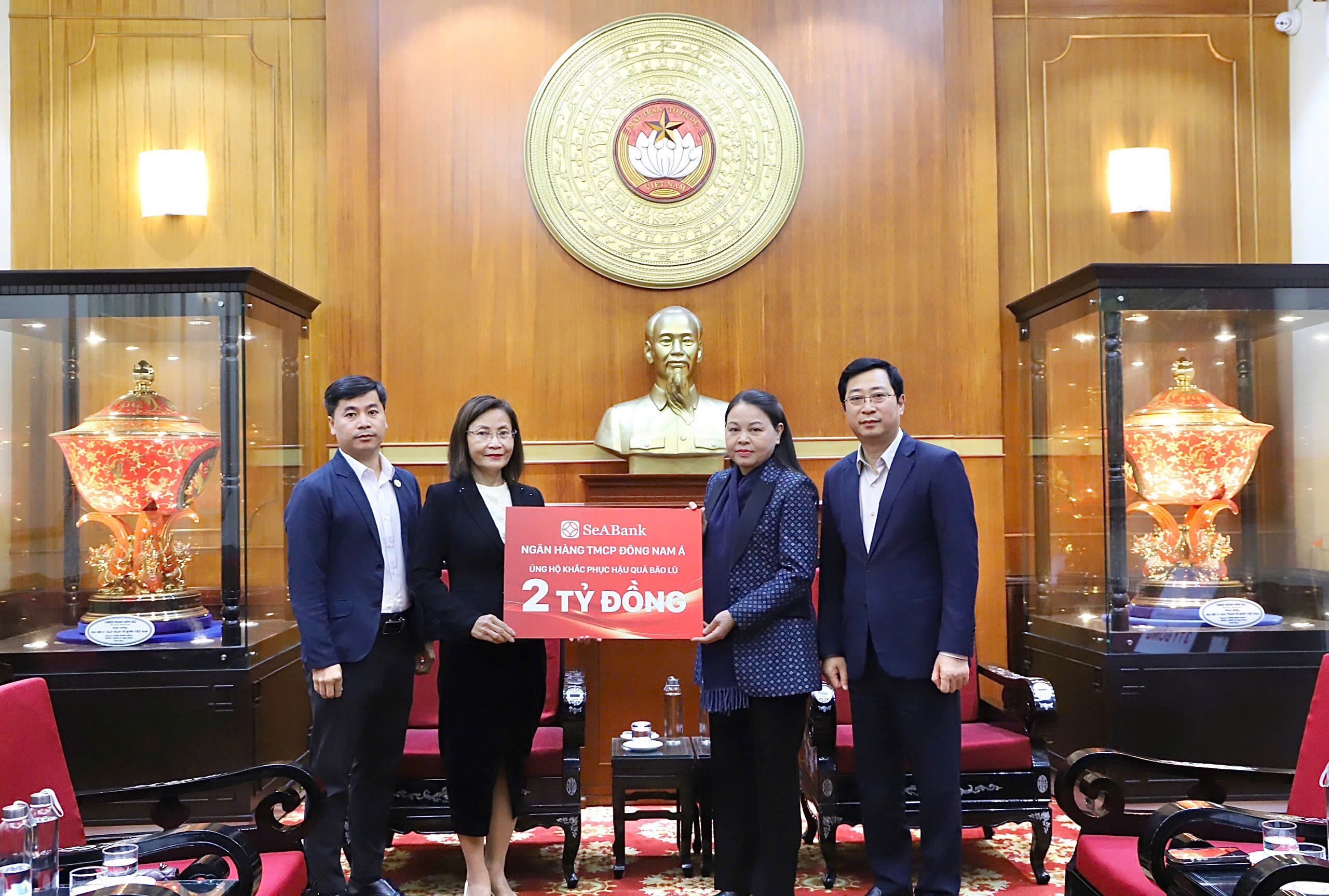

SeABank donates nearly VND6.2 billion to support recovery and reconstruction after storms and floods

Guided by the vision of ‘Putting People and Communities First,’ Southeast Asia Commercial Joint Stock Bank (SeABank, HOSE: SSB) carried out multiple urgent response initiatives to successive storms and floods in 2025, with total contributions of nearly VND 6.2 billion. Through these efforts, SeABank and its employees joined hands with affected communities to accelerate post-disaster recovery.

20/01/2026

Read more

SeABank Launches 2026 Lunar New Year Promotion & Celebrates Its 32nd Anniversary for Individual Customers

In celebration of the 2026 Lunar New Year and the milestone of 32 years of establishment and development, SeABank would like to extend its sincere appreciation to our valued customers for their trust and long-term companionship. This gratitude is expressed through a large-scale promotional program offering many attractive lucky draw opportunities.

19/01/2026

Read more