News

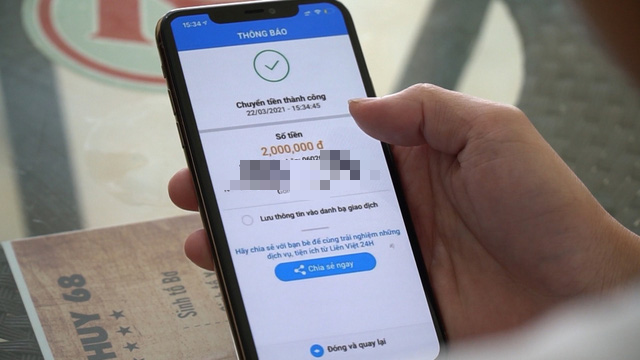

Personal Bank Transfers That May Be Taxed: Important Information for Account Holders

03/07/2025

Not all transfers into accounts are taxable, but people need to pay special attention to the following cases to avoid legal risks and unwanted tax collection.

In the context of increasingly popular non-cash transactions, it is extremely important to understand the regulations on personal income tax (PIT) for money received through bank accounts. Not all money transferred into an account is taxable, but people need to pay special attention to the following cases to avoid legal risks and unwanted tax collection.

Tax authorities determine tax obligations based on the nature of the transaction, that is, whether the money is taxable income or not, not simply based on the amount of money in and out of the account. Below are the amounts of money transferred into a personal account that you are subject to PIT:

1. Salaries, wages and similar income

This is the most common type of taxable income. When you receive salary, bonuses, allowances and other amounts of the nature of salary or wages from your employer (company, organization), this amount will be subject to PIT according to the progressive tax schedule. Enterprises are responsible for deducting taxes before paying employees.

However, if you have income from two or more places, you must settle taxes with the tax authority yourself at the end of the year. All salaries received through the account are recorded and are the basis for the tax authority to compare.

2. Income from business activities

If you use a personal account to receive money from business activities, online sales, providing services (for example: design, consulting, writing ...), this income is subject to tax. Specifically, you will have to pay personal income tax and value added tax if the revenue from business activities is over 100 million VND/year.

Tax authorities can monitor accounts with large, frequent transactions to determine business activities and require full tax declaration and payment.

3. Income from providing services, commissions

Service fees such as brokerage fees, commissions, or fees from money transfer/withdrawal services are all taxable income. Although the principal amount in a "money withdrawal" transaction is not taxable, the service fee you receive will be subject to personal income tax.

4. Income from loan interest

If an individual lends money to an organization or company and receives interest, that interest will be subject to personal income tax at a rate of 5%. This tax will be deducted by the borrower (company) before paying interest to you.

In contrast, interest arising from loans between individuals is currently not subject to personal income tax.

5. Income from real estate transfer (in case of fraudulent declaration)

In principle, when selling a house or land, the seller must pay 2% personal income tax on the transfer price at the time of notarization of the contract. If the actual amount received through the account matches the declared price, this amount will no longer be taxed.

However, a big risk arises when the seller and buyer intentionally declare a price on the contract much lower than the actual transaction value to evade tax. If the tax authority discovers this difference through the cash flow in the bank account, they have the right to re-determine the selling price and collect the remaining personal income tax along with late payment penalties.

To avoid unnecessary trouble, people should:

Transparent transactions: Use separate accounts for business purposes and personal expenses.

Keep documents: Always keep contracts, invoices, authorization papers, or other evidence to prove the origin and nature of the money received.

Declaration honestly: Especially in large transactions such as real estate, declaring the actual value will help you avoid legal and financial risks later.

Source: Cafebiz.