News

What is CVV number? Functions and 5+ effective ways to secure CVV numbers

25/04/2025

The CVV number is mThis is one of the important parts of a credit card and when exposed, customers will have their personal information stolen and their assets easily misappropriated. So what is CVV number? Let's learn in detail about the concept and ways to protect CVV codes in the article below.

1. What is CVV number?

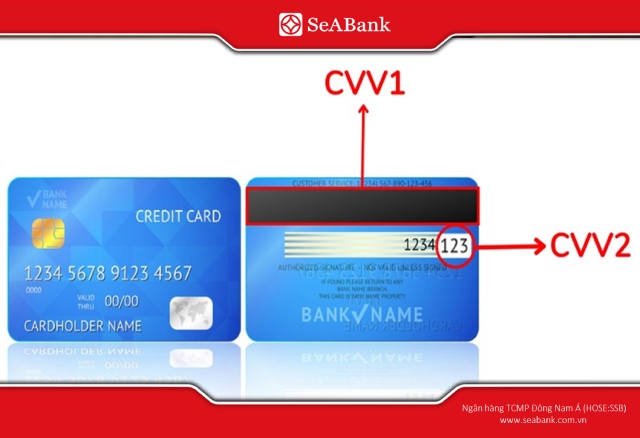

CVV number (Card Verification Value) is a security code used in international payments, consisting of 3 digits printed on the back of international debit/credit cards issued by the Visa system. The CVV number on the card will include 2 types:

- CVV1: The security code is not displayed directly but is stored in the magnetic strip or chip of the card, used when the cardholder conducts transactions through POS or ATM machines.

- CVV2: 3-digit security code printed on the back of the card, used to authenticate the owner in payment transactions on the Internet.

2. Function of CVV number

CVV numbers are used to verify transactions, ensuring safety for cardholders. CVV1 number and CVV2 number will have different functions:

- Functions of CVV1 number: When cardholders pay via POS or withdraw money at an ATM, these devices will read the information stored in the CVV1 number to authenticate the transaction. Besides, CVV1 ensures that this is a real card issued by the bank, helping to limit the risk of counterfeiting or copying card information.

- Functions of CVV2 number: Through the CVV2 number entered by the user, online payment platforms will identify the transaction as the cardholder. According to PCI DSS security standards, CVV2 code information is not stored on the payment system so users can feel completely secure.

3. 5+ effective ways to secure CVV numbers

There are many cases where CVV numbers are leaked due to: POS machines in stores and websites are infected with malware, users do not cover their CVV numbers carefully, allowing others to see and take advantage of them.

If the CVV code is revealed on a credit card, thieves can steal information and perform fraudulent transactions and appropriate property. Therefore, customers need to know how to secure CVV card numbers through the following ways:

3.1. Do not share CVV numbers

This is an extremely important rule that cardholders need to remember. Customers absolutely do not share credit card numbers or CVV codes with anyone, including bank staff, to avoid acts of profiteering.

3.2. Cover CVV number

Client You should remember the CVV number on the card for convenience when paying online, then use tape or stamps to cover the code or even erase it. This helps ensure the code is not leaked during payment, captured by thieves and sold for information, minimizing the risk of losing the card.

Broken stamps are often attached by the bank to the new card envelope when the customer receives the card for convenient replacement when needed.

3.3. Transactions at secure websites

Websites that do not meet security criteria are vulnerable to hackers, causing users' card information to be stolen and used for fraudulent purposes. Therefore, customers should only make online payment transactions at large, reputable websites with a lock symbol and the "" protocol".https://”. These are highly secure websites, helping to ensure that customer data is encrypted and protected during transmission and reception.

3.4. Monitor your account regularly

Banks today provide account change notification services via SMS or Email 24/7. Besides, users should register for the service Verified by Visa to receive an OTP code sent to your phone when a transaction occurs. These are effective solutions to promptly detect unusual transactions, helping to better protect accounts.

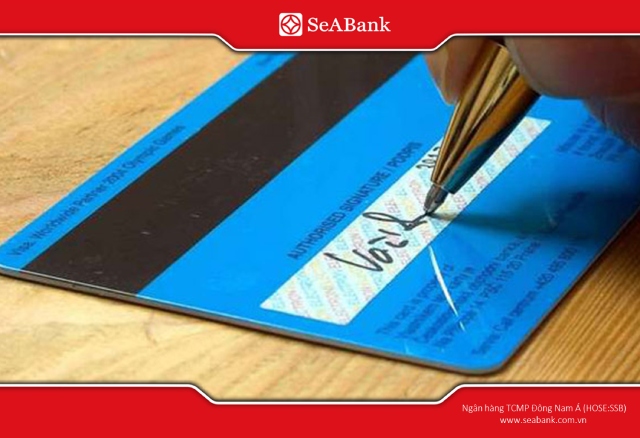

3.5. Sign the back of the card

Cashiers at points of sale will usually compare the signature on the card with the signature on the receipt. Therefore, customers should sign on the back of the card to prevent thieves from using the card for personal gain after stealing.

3.6. Use non-physical cards

Many banks have provided non-physical card services with card information completely similar to physical cards. Customers can make payments, manage and control transactions via banking applications without needing to carry a card.

Customers can easily link the card with mobile payment applications such as Apple Pay, Samsung Pay, Google Pay... to make contactless payments, conveniently when shopping in person and online. This not only brings convenience and speed but also minimizes the risk of information leakage when giving the physical card to others.

3.7. Do not use public wifi

Using public wifi to pay is a potentially risky habit that many people are doing. Public Wifi has poor security, transmitted information is not encrypted, so it is easy to leak. Therefore, customers should use personal mobile data when paying via credit cards in particular or other payment cards in general.

4. Instructions on how to use CVV number to make payment

How to get CVV code?

How to get CVV code is very simple. The CVV code is usually shown as 3 digits on the back of the card. Some cards print the CVV code on the back, next to the last 4 digits of the card. Customers need to pay attention to the difference between these series of numbers to get the correct CVV code.

For some types of cards that do not print CVV to improve security, customers can access the online banking application to get the code by authenticating the PIN code, OTP code or face. After having the CVV number, customers will make payment through simple steps.

For payment at POS machines

- Step 1: Give the payment card to the cashier to swipe the card through the POS machine

- Step 2: Enter the CVV security code to confirm the transaction. Please note that you should carefully cover your hands when operating

- Step 3: Sign to confirm the invoice and get your card back

For online payments

- Step 1: Select payment method via credit card

- Step 2: Complete all information fields including: Cardholder name, card number, card expiration date, CVV number

Step 3: Confirm payment using OTP code or password depending on the payment platform's requirements. Customers can get the OTP code and send it to the card-issuing bank application or send it to their phone.

Note: When using CVV codes to pay online, you need to ensure that transactions are only made at trusted, highly secure websites/applications. Customers should only enter card information on their personal devices, not allowing browsers to remember this sensitive information.

Understanding what a CVV number is and its importance helps customers protect their financial information. In addition, customers need to comply with security and safety rules and be careful in using international payment cards to feel secure when making transactions.