News

What is eKYC? 5+ benefits for banks and service users

25/04/2025

eKYC solutions are increasingly being applied in many fields, especially the banking and finance industry. eKYC helps simplify procedures and documents, bringing convenience to users and banks.

1. Overview of eKYC

1.1. What is eKYC?

eKYC (Electronic Know Your Customer) is a solution that allows banks to authenticate electronic customers 100% online based on biometric information, artificial intelligence...

eKYC is applied to authenticate customers when opening a new online account. From the online payment account, customers can perform many operations such as: Transfer money, open an online savings book, pay bills...

1.2. Application technologies

eKYC often uses the following technologies to verify customer identity:

- OCR: By scanning and converting text in images into readable data, OCR helps identify and extract information from paper documents such as ID cards and passports....

- Facematch: Facial recognition technology helps compare customers' portrait photos with identification documents to ensure the account registrant matches the person whose name is on the documents.

- E-Signature: Electronic signature helps confirm transactions are made by the owner to protect consumer rights.

- Liveness Detection: This is a technological barrier to prevent face spoofing, ensuring account security at two levels. This technology will verify that the user is operating as the owner and in real time, not in use still images, pre-recorded videos, masks…

2. Security forms of eKYC

To ensure the highest safety for customer accounts, eKYC uses some of the following security forms:

- Username and password: This is a common form applied to all bank accounts today. Customers can create a login account with a password consisting of letters, numbers, and special characters... with high security.

- Fingerprint or Face ID: Every time you log in to your account, the system will request verification via fingerprint and Face ID facial recognition that was previously installed.

- OTP authentication code: This is the most modern, highly secure verification method used for many types of accounts. Accordingly, when the user conducts a transaction, the system will send an OTP code to the registered phone number for authentication.

3. Benefits of eKYC for users and banks

3.1. For users

3.1.1. Save time

eKYC helps users save maximum time and effort when opening an account. Accordingly, account opening can be completely done via mobile phone thanks to the eKYC application for identity authentication. This operation only takes a few minutes, so customers do not need to wait in line at the transaction counter.

3.1.2. Own a quick trading account

After just a few simple steps, customers immediately have an account to make transactions as well as experience the bank's convenient online services. Customers can use eKYC accounts for transactions and interbank transfers with limits up to hundreds of millions of VND depending on the policies of each unit.

3.1.3. Minimize errors

Instead of manually entering information on identification documents, the eKYC solution will support users to automatically retrieve and update information on the system. This process not only helps customers save time but also minimizes errors.

3.2. For banks

3.2.1. Helps save personnel costs

With eKYC, customers can completely perform identity verification operations themselves. Besides, eKYc data is transmitted completely in real time without any human intervention. This is an important factor to help optimize personnel costs.

3.2.2. Easily manage and monitor risks

Instead of storing customer information in physical paper form at each individual branch, all information fields will be digitized and stored into a unified data warehouse. All transactions and verification information are stored in the system with a high level of security, allowing financial institutions to easily retrieve and re-check data when necessary.

Besides, electronic identification through eKYC is equipped with many modern security technologies, Able to continuously monitor and analyze customer activities throughout the process of interacting with the system. The bank will identify potentially fraudulent behavior patterns to promptly handle and propose preventive measures.

3.2.3. Attract many new customers

eKYC technology brings a new, modern experience, helping customers save time and effort. Therefore, most banks in Vietnam apply this solution to attract many service users as well as increase the professional image of the unit.

4. eKYC operating process

The identity verification process through eKYC takes place in just a few minutes. Customers will do so through the electronic banking application with 4 simple steps:

- Step 1: Customers fill in all necessary information requested on the application and select the type of identification document they want to use to verify data (Citizen ID, passport...)

- Step 2: The eKYC system will extract information on identification documents through OCR technology. Customers need to check the information and edit if necessary.

- Step 3: Customers take portrait photos (selfies) or take selfie videos. Through technology Liveness detection and Face matching, the system will compare the photo taken with the image on the provided document to complete the authentication process.

- Step 4: After successful authentication, customers can use the account for transactions.

5. Open an online eKYC account simply and quickly with SeABank

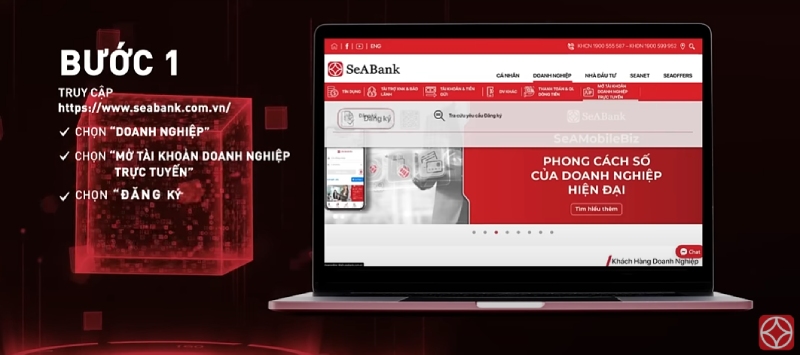

With the purpose of bringing customers convenience and speed, SeABank deploys online eKYC account opening for business customers who have never owned an account at SeABank through 5 simple steps:

- Step 1: Customers access the SeABank website, go to the menu Enterprise, select Open a business account online.

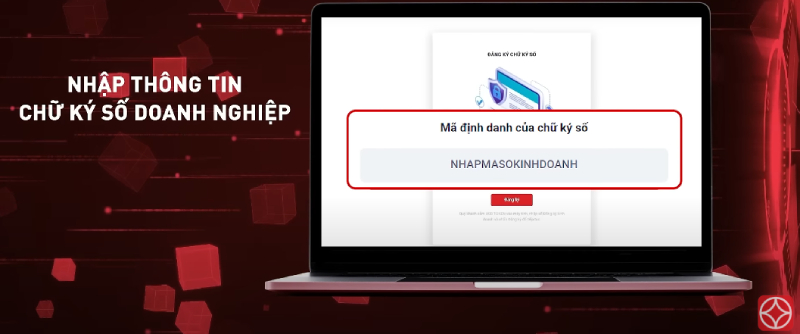

- Step 2: Customers download and install SEA - CA software to install plugins. After successful installation, insert the USB digital signature token into the device and enter digital signature information business.

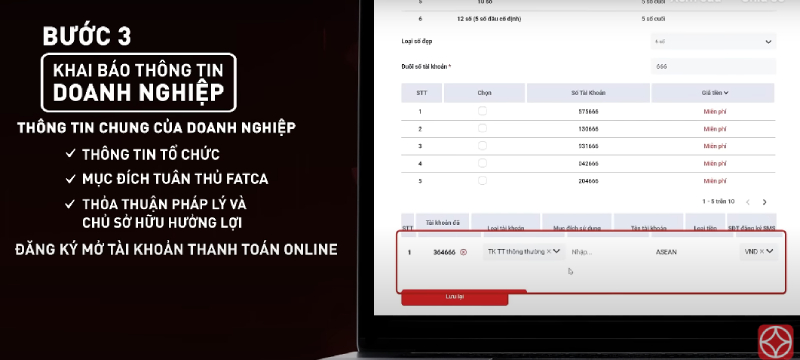

- Step 3: Customer declares General business information and Registration information to open an online account.

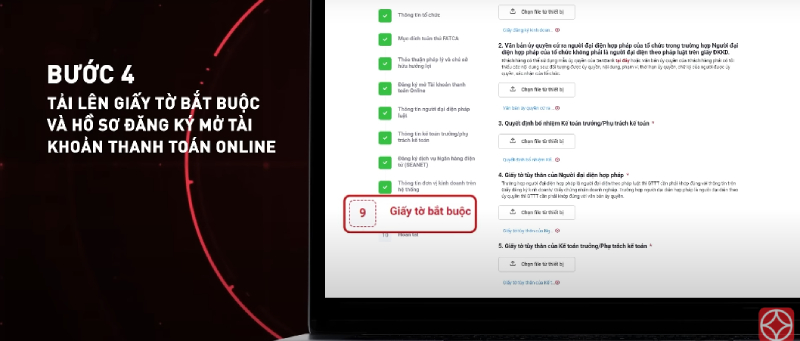

- Step 4: Customers upload scanned copies of the Required documents and Application for opening an online payment account onto the system.

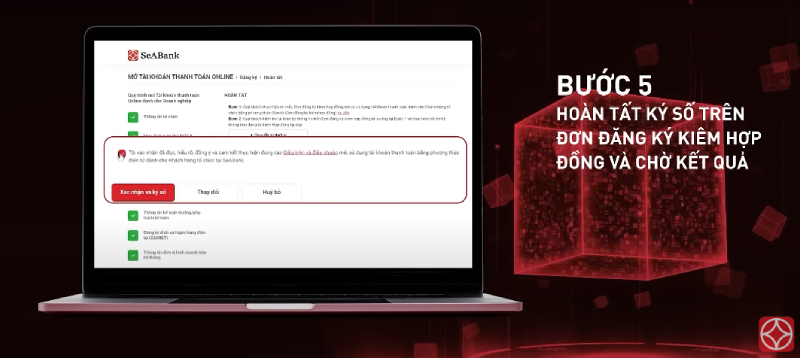

- Step 5: Customers use digital signatures and Sign confirmation on the service contract application, enter my OTP and wait for the results of the application appraisal to be notified via business email/sms.

SeABank eKYC accounts are chosen by many business customers because of many outstanding benefits:

- Fast and convenient: All procedures are done online, no need to go to the counter. Opening an account and registering for e-banking services are integrated in the same registration.

- Give away a nice account number: Customers are given beautiful digital accounts worth up to 10 million copper, flexibly choose up to the last 5 numbers of the account.

- Free service: Free registration, use and domestic money transfer fees on SeANet/SeAMobile biz.

6. Some frequently asked questions about eKYC

1. What is eKYC authentication?

Waiting for eKYC authentication is the process of waiting for the system to check and approve information. Waiting time can last from a few minutes to a few days depending on the service you are using (bank, e-wallet...) as well as the processing procedures established on each unit's system.

2. What is an eKYC debit account?

This is an account linked to a debit card, allowing users to make payment transactions and withdraw money from the account balance. Debit accounts are widely used in daily transactions and can be opened online through a bank's eKYC process or an e-wallet.

3. What is electronic customer identification?

This is the process of verifying customer identity through the online environment, performed on mobile devices without having to go directly to the transaction counter.

In general, eKYC not only brings convenience and speed to service users but also contributes to saving costs and optimizing working efficiency for banks. Among them, nSeABank branch with the application of eKYC electronic identification technology and advanced security layers helps business customers open online accounts simply, quickly, and with high security.

If customers have any questions or need further advice about products/services at SeABank, please contact the hotline. 1900 599 952 for inquiries.

Related News

How much is 14K gold? Update the latest 14K gold price 2025 28/11/2025

What is 7749? Decoding the meaning from folk concept to Gen Z language 28/11/2025

How much is 10K gold? Update the latest 10K gold price 2025 28/11/2025

How much is 1 million Chinese Yuan in Vietnamese Dong? Update the latest CNY exchange rate 28/11/2025

What is 750 White Gold? All About Price and Features 28/11/2025

How much is 14K gold? Update the latest 14K gold price 2025

How much is 14K gold today? Update the latest 14K gold buying and selling prices in 2025 and instructions for converting 1 tael of 14K gold.

28/11/2025

Read more

What is 7749? Decoding the meaning from folk concept to Gen Z language

Discover the meaning of number 7749 from folk beliefs to Gen Z language and how to choose a beautiful, feng shui-compliant account number at SeABank.

28/11/2025

Read more

How much is 10K gold? Update the latest 10K gold price 2025

How much does 10K gold cost? Learn more about 10K gold - the most durable and cheapest gold, suitable for everyday jewelry.

28/11/2025

Read more