News

What is SWIFT Code? Look up international bank identification codes in Vietnam

17/10/2025

Join SeABank to learn what SWIFT Code is, its meaning and how to use it in international transactions. Watch now to not miss important information!

Nowadays, the need for money transfer and international payment is increasingly popular, not only with individuals receiving remittances but also with import-export businesses. For transactions to take place quickly, safely and accurately, an indispensable mandatory information is the SWIFT Code. So what is the SWIFT Code, what is its structure, why is it important in cross-border transactions and how to look it up accurately? The following article will help you have the most complete and comprehensive view.

Quick summary of main content:

- SWIFT Code is a unique international identifier of a bank/financial institution, managed and used by the SWIFT Association.in global financial transactions, ensuring security and standardization of information.

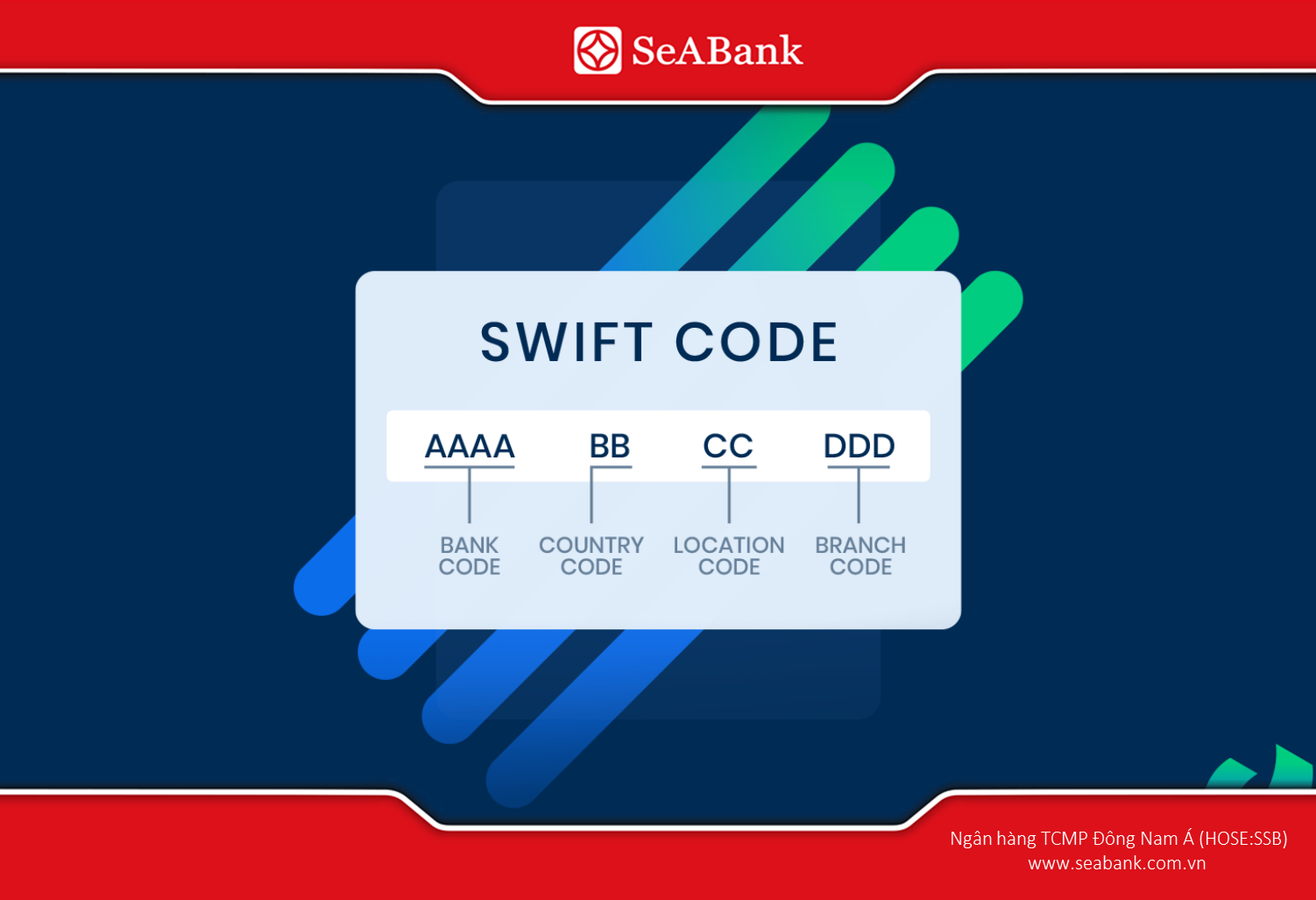

- SWIFT Code structure includes 8 or 11 characters: AAAA (bank) – BB (national) – CC (local) – DDD (branch).For example: SEAVVNVX (SeABank, Vietnam, main branch).

- How to look up the correct SWIFT Code

- On the bank's official website.

- Through reputable SWIFT/BIC directories.

- On the statement, transaction contract.

- Contact bank hotline/call center.

1. What is a SWIFT Code?

SWIFT Code, also known as BIC (Business Identifier Code), is a global identifier that accurately identifies a bank or financial institution in international transactions. Each SWIFT code is unique, like a bank's "identity card", ensuring that money and payment information are transferred to the right place and to the right person.

SWIFT stands for Society for Worldwide Interbank Financial Telecommunication. This organization was founded in Brussels, Belgium in 1973, with the mission of building a standard, fast and secure information system for the international financial industry.

Today, the SWIFT network is used in more than 200 countries with tens of thousands of member banks and financial institutions, acting as the “backbone” for global transactions. Not only limited to money transfer orders, SWIFT Code is also used in many other types of financial messages such as payment advice, debit advice, credit advice, letters of credit, securities and many financial derivative products.

2. SWIFT Code structure and conventions

To ensure uniformity and easy identification, SWIFT Code is built according to international standard structure. Thanks to that, any bank in the world when participating in the SWIFT network can be identified accurately and consistently.

2.1. SWIFT code length

A SWIFT code can consist of 8 or 11 characters. Specifically:

- The first 4 codes are used to identify the bank.

- The next two codes are used to identify the country.

- The next 2 codes will be local.

- The last 3 codes identify the branches.

2.2. Meaning of each character

The standard structure of a SWIFT code is usually denoted as AAAABBCCDDD, where:

- AAAA (first 4 characters):Bank code – consists of letters A–Z only, represents the bank's abbreviation.

- BB (next 2 characters):Country code – follows ISO 3166-1 alpha-2 standard. For example, Vietnam is specified as VN.

- CC (next 2 characters):Local or city code – can be letters or numbers, used to distinguish areas of operation.

- DDD (last 3 characters):Branch code – optional. If this part is omitted (ie only 8 characters), the default is the central branch.

For example, the SWIFT code of SeABank is written as SEAVVNVX. Where SEAV is the bank code, VN is the country code (Vietnam) and VX is the locality/main branch code. If a specific branch needs to be specified, the code can be extended to 11 characters with the last 3 characters indicating the branch.

Thanks to this unified structure, the SWIFT system ensures that all international financial transactions are always fast, accurate and error-free.

3. Function and meaning of SWIFT Code

Not only a series of characters identifying a bank, SWIFT Code also has many important functions in international financial transactions. Each SWIFT code acts as a "passport" to help connect global banks, ensuring both safety and improving transaction efficiency. Below are typical functions:

3.1. Identify the exact bank and branch

SWIFT Code acts as an “international identity card” for banks, helping the payment system accurately identify the beneficiary among tens of thousands of global banks. Each code is unique, without duplication, ensuring that the transaction will go to the correct “address”.

In particular, when the transaction involves a specific branch, the extension of the SWIFT Code (11 characters) allows for a clear distinction of which branch will receive the money. This minimizes the risk of mistransfer or loss during the international transaction processing.

3.2. Ensure transaction safety and security

The SWIFT network is built on a multi-layered security platform, applying advanced encryption standards to protect data during transmission. This helps banks and financial institutions feel secure when sending sensitive information such as money transfer orders, credit or debit notices.

In addition, all transactions are monitored and recorded according to global standards, reducing the risk of information leakage or cyber attacks. This is a key factor that has helped SWIFT become the number one choice in international financial transactions for decades.

3.3. Increase transaction speed and efficiency

Previously, international money transfers were often manual, resulting in long processing times and errors. With the advent of SWIFT Codes, money transfers were automated and routed directly to the correct beneficiary bank.

This significantly shortens the transaction processing time, in many cases taking only 1-2 working days. At the same time, transparency is also enhanced as customers can easily track the status and history of transactions.

3.4. Standardization of global transactions

One of the greatest values that SWIFT brings is the ability to create a “common language” for the banking system worldwide. Regardless of which country a bank operates in, as long as it has a SWIFT code, transactions are understood and processed according to the same standards.

This not only simplifies the transaction process but also creates a close connection between banks, promoting international trade and cross-border investment. It can be said that SWIFT is an important bridge in the global financial ecosystem.

3.5. Support risk management and incident handling

In case of dispute, mistake or incident in transaction, SWIFT Code is the first database for banks to check and trace the origin. Each unique identifier helps to determine exactly where the money flow has gone and where it stops.

This not only helps shorten the investigation time but also increases transparency, helping customers resolve complaints quickly. At the same time, thanks to SWIFT, banks can better manage risks and increase customer confidence in international money transfer services.

4. Distinguish between SWIFT Code and Bank Code

In the process of learning about banking transactions, many people often confuse betweenSWIFT Code and Bank Code. In fact, although they are all bank identification codes, each type has a different scope of application, structure and purpose of use. Understanding this difference will help you use the correct code in each situation, avoiding errors when making domestic or international transactions.

Alike

- Both are bank identifiers, serving transaction purposes.

- Help the financial system accurately identify the transaction object.

Different

SWIFT Code and Bank Code are both bank identifiers, but they are used in different contexts. Understanding the difference helps you choose the right code for each transaction, avoiding confusion and unnecessary risks.

5. Services that SWIFT Code brings to customers

In the era of integration, SWIFT Code is not only a tool for identifying banks, but also a “key” to open the global financial services system. Thanks to SWIFT, individuals and businesses can conduct many international transactions safely, quickly and transparently, from money transfer, payment to risk management. Specifically, SWIFT Code brings the following outstanding utilities:

- International money transfer: The sender needs to provide the SWIFT Code of the beneficiary bank to ensure the money goes to the correct recipient bank.

- Payment for international goods and services: Import-export businesses use SWIFT Code to ensure accurate payments to foreign partners and have documents according to international standards.

- Receive money from abroad: The beneficiary in Vietnam needs to provide their bank's SWIFT code to the sender abroad to receive money into their account.

- Various financial transactions: SWIFT supports many types of messages: payments, guarantees, securities transactions, credit/debit advice… helping financial institutions perform many cross-border services.

- Support eKYC, AML and compliance management: Information transmitted via SWIFT can be used in conjunction with electronic know-your-customer (eKYC) and anti-money laundering (AML) procedures to enhance the safety of the financial system.

6. How to look up the correct SWIFT Code

Determining the correct SWIFT Code is an important step in every international transaction, because just entering one wrong character can delay the transaction or even fail. To ensure safety and save time, customers can refer to the following popular and effective lookup methods:

6.1. Look up on the bank's official website

This is the most accurate and reliable method, as the information is provided directly from the bank. You just need to access the official website, find the section “Contact Information”, “Customer Support” or FAQ section.

All SWIFT Codes published here are the latest updates and are in line with the international money receiving process that the bank is applying.

6.2. Look up through reputable SWIFT/BIC directory sites

Many websites compile SWIFT codes by country and bank, allowing you to search quickly. However, to avoid errors, it is advisable to cross-check this information with the official website of the beneficiary bank. This will save you time and ensure accuracy when making international transactions.

6.3. View on account statement or transaction contract

Some banks pre-print the SWIFT Code on account statements, card opening contracts or international money transfer forms. This is a direct, legal source of information and is regularly updated with customer-related documents.

6.4. Contact the bank hotline/call center

In case of any doubt, calling the customer service hotline is the safest and fastest way to confirm the information. The bank staff will assist in providing the correct SWIFT code and answer any questions related to the international money receiving process.

SWIFT Code is basic but extremely important information in all cross-border financial transactions. Understanding the structure, function and how to look up correctly will help you transfer/receive international money faster, safer and avoid risks due to code errors. Before making a transaction, always check the SWIFT Code with the bank's official source to ensure accuracy.

If you are looking for a bank with a wide international network, fast and secure money transfers, SeABank is a reliable choice. With the international standard SWIFT Code system, SeABank supports customers to make global transactions safely, conveniently and cost-effectively.