News

Learn about ATM cards: Characteristics, classification, and benefits

10/04/2025

ATM cards have become an essential financial tool, bringing convenience and safety in daily transactions. In this article, SeABank will provide complete and detailed information about ATM cards, including outstanding benefits, classification of notes when using, and helping customers easily choose an ATM card that suits their needs.

1. What is an ATM card?

ATM card is not actually an official term that banks use. ATM card is a type of card used to perform automatic transactions at ATMs such as withdrawing money, transferring money, depositing money, and checking account balance. In addition, this card can also support bill payments and online shopping depending on the specific features of each card type.

ATM cards play an important role in managing personal finances and making payments in modern banking.

- Easy withdrawal and transfer: With an ATM card, you can quickly withdraw cash or transfer money at any ATM belonging to the banking system or affiliated partners.

- Deposit money directly into your account: Users can easily deposit cash into their accounts through ATMs that support this feature, helping to save time when customers do not need to go to the transaction counter.

- Pay utility bills: ATM cards allow payment of electricity, water, telecommunications, and other service bills directly at the ATM or via linked banking applications.

- Shopping at POS and online: Use ATM cards to pay at stores, supermarkets or online shopping, helping you minimize the use of cash in all daily transactions.

- Check your balance and manage your account anytime: You can check your account balance, print transaction statements, or change your PIN safely and securely at ATMs or through the online banking app.

2. Benefits of using ATM cards

Save time and optimize financial transactions

The ATM system supports users to quickly perform transactions such as withdrawals, deposits, and transfers without having to wait at the transaction counter. This not only saves time but also brings significant convenience.

In particular, transactions at ATMs are performed completely automatically with modern machines, ensuring fast and accurate processing speed. The ATM system operates 24/7, helping users easily perform transactions regardless of time, completely different from the bank's business hours.

Ensure safety and security in transactions

Modern ATMs integrate advanced technology to secure each transaction, such as:

- EMV technology: Is a payment card security technology via an EMV chip, creating a unique confirmation code for each transaction, helping to protect customers' card information from copying and unauthorized use.

- NFC technology: Contactless transaction technology helps users pay quickly, just by bringing the card near the ATM without swiping or inserting the card into the slot. This technology increases convenience and security thanks to the ability to encrypt data transmitted between devices over short distances.

- Tokenization technology: Encryption technology works based on the principle of encoding data into unique code sequences, helping to protect payment data during transmission, reducing the risk of card information being stolen or misused.

Support effective personal financial management

ATM cards allow users to track detailed account balances and transactions through digital banking applications. In addition, integrated spending reporting tools help users easily control budgets, make financial plans and realize personal financial goals scientifically and effectively.

3. Popular types of ATM cards

ATM cards are currently divided into many different types based on scope and purpose of use. Below are common types of ATM cards:

- Domestic ATM card: This type of card is designed primarily for use within the territory of Vietnam, issued through the Napas system. Domestic cards support basic transactions such as withdrawals, transfers, and bill payments at ATMs and domestic transaction points, bringing convenience and safety to users.

- International ATM card: International ATM cards are issued by systems such as Visa, Mastercard, JCB, or American Express, allowing customers to use them at international and domestic transaction points. This type of card is especially suitable for customers who frequently travel, work abroad, or have global payment needs. The card supports shopping and spending everywhere that accepts international card systems, providing outstanding convenience in transactions.

- Linked ATM card: This card is issued through cooperation between the bank and reputable partners such as supermarkets, airlines, or big brands. In addition to basic features, affiliate cards also offer many exclusive incentives such as discounts, cashback, or points when making transactions at affiliated partners.

Each type of card has its own advantages, meeting the diverse financial needs of customers. Choosing the right card type will help optimize your usage experience and take advantage of the benefits the card brings.

4. An ATM card is a credit card or debit card

ATM cards can be credit or debit cards, depending on each bank's program, However, the most popular ATM card today is the domestic debit card, with flexible features, supporting basic transactions such as withdrawals, transfers, or bill payments. This type of card satisfies users' daily financial needs thanks to its convenience and safety.

Credit cards can also make withdrawals at ATMs if necessary. However, because withdrawal fees are often higher than debit cards, this type of card is more commonly used for online and international payments or shopping.

Credit Card (Credit Card): Credit cards, also known as Credit Cards, operate based on the credit limit issued by the bank, allowing users to spend first and pay later. This type of card is often used for shopping and payment purposes; however, withdrawing cash using a credit card is not recommended because the withdrawal fee is quite high.

Debit Card: This type of card is linked directly to the user's bank account, limiting spending to the available balance. This type of card is popular in cash withdrawal transactions, bill payments and use at POS card acceptance points. Conditions for opening and using a debit card are easier than credit cards.

5. Conditions and procedures for opening an ATM card

5.1. Conditions for opening a card

To open a bank card, customers need to meet some basic conditions:

- Be a Vietnamese citizen or a foreigner residing in Vietnam for 12 months or more.

- From 15 years old and up.

- Have one of the original and valid ID/CCCD/Passport documents.

- Individuals with full capacity for civil acts.

- Required documents will be different when making different types of cards. The profile of a debit card will be completely different from the profile of a credit card... Therefore, you need to go directly to the bank to register the card so that the staff can advise and complete the documents. Or, some banks will accept online banking through Internet banking or Mobile banking.

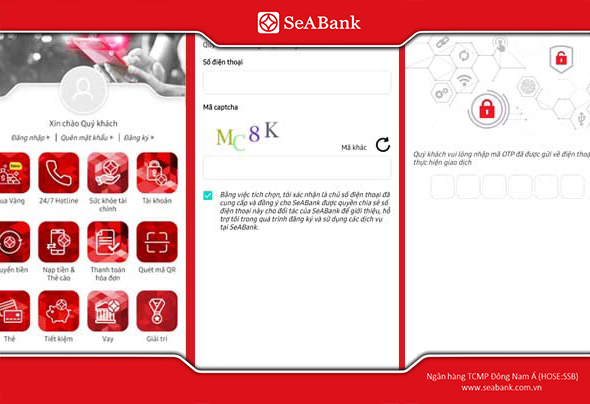

5.2. Card opening process at SeANet/SeAMobile

- Step 1: Access the application SeANet/SeAMobile cSelect Card > Register for card issuance > Physical credit card

- Step 2: Choose the card type that suits your needs > Choose to register to open a card

- Step 3: Fill in card issuance information > select continue

- Step 4: Confirm the entered information

- Step 5: Fill in the OTP code/Pin code to complete card issuance registration

See more: Instructions for registering a credit card online on SeANet/SeAMobile

SeABank is committed to providing effective and safe financial solutions through modern and convenient ATM card opening services. Customers can contact hotline 1900599952 for detailed advice and support.

6. Instructions for using ATM cards safely

To ensure safety when using ATM cards, customers should note the following measures:

- Change your PIN periodically: Changing your PIN regularly helps increase account security, avoiding the risk of information disclosure.

- Secure card information: Do not share card information or PIN with anyone to avoid the risk of data theft.

- Use a reputable ATM: Choose ATMs that belong to the banking system or reliable affiliate partners to perform transactions.

- Check transaction information: Always carefully check transaction information before confirming to ensure accuracy.

- Follow transaction notifications: Use an SMS notification service or banking app to monitor all activity related to your account.

7. Some frequently asked questions

Question 1. Can SeABank ATM cards withdraw money from other banks?

Yes, SeABank's ATM card is connected to the interbank system, allowing you to withdraw money at ATMs of other affiliated banks. However, you should note that transaction fees may arise according to the regulations of each type of bank card

Question 2. What does the cost of using an ATM card include?

Costs related to ATM cards usually include issuance fees, annual maintenance fees, transaction fees at ATMs other than banks, and other additional service fees, if any. For details, you should contact SeABank directly for specific advice.

Question 3. How to handle a lost card or suspected card theft?

When you discover your card is lost or suspect it has been stolen, you need to immediately contact SeABank's hotline to lock the card urgently. You can then request a new card at the nearest branch or via the online banking application.

ATM cards have become an indispensable part of modern life, meeting the need for fast, safe, and convenient financial transactions. With diverse features and advanced technology, ATM cards not only support payments and withdrawals but also help manage personal finances effectively.

Related News

RISK SITUATION ALERT BULLETIN – Q3/2025 25/09/2025

Summary of Popular Bank Loan Types: Advantages, Disadvantages, and Key Considerations 20/09/2025

Credit Scores: Definition, How to Check, and Quick, Accurate Online Verification 19/09/2025

Paying Electricity Bills by Credit Card: Detailed Guide and Key Considerations 18/09/2025

What Is Credit Card Balance Transfer? The Fastest and Most Effective Way to Do It 17/09/2025

RISK SITUATION ALERT BULLETIN – Q3/2025

Dear Our Esteemed Clients,

25/09/2025

Read more

Summary of Popular Bank Loan Types: Advantages, Disadvantages, and Key Considerations

Classifying different types of bank loans helps both customers and banks clearly define purposes, conditions, and the pros and cons of each product. This ensures choosing the most suitable financial solution for personal or business needs. Each loan type serves distinct purposes, from personal spending to production and business investment.

20/09/2025

Read more

Credit Scores: Definition, How to Check, and Quick, Accurate Online Verification

A credit score is among the most important indicators that determine your access to financial services in Vietnam—such as loans, credit card issuance, and installment purchases. Understanding your credit score, how to check it, and how to improve it will help you manage personal finances proactively and strengthen your credibility with financial institutions.

19/09/2025

Read more