News

24/03/2022

One of core values stated out by Southeast Asia Commercial Joint Stock Bank (“SeABank”) are “Community Oriented” and “Sustainability”; therefore, development and implementation of Environmental and Social (E&S) Risk Management Policies is a definitely important key for SeABank to pursue growth complying with our core value statement and contribution to the sustainable development of the community.

Since 2022, an internal regulation on E&S risk management system has been in place at SeABank, the regulation has been developed in accordance with currently national laws on the environmental protection; labour; occupational health and safety; cultural heritage; biodiversity; water resource, etc. SeABank has also referred to IFC’s E&S performance standards, a member of the World Bank Group, during the establishment and implementation of this regulation.

SeABank believes that E&S risk management is an integral part of credit risk management at the Bank. Therefore, we integrate the assessment and monitoring of E&S risks with the assessment of other risks when assessing clients’ credit application and post lending monitoring of clients. We believe that, in parallel with the credit quality assurance of the Bank by identifying, preventing and managing potential E&S risks from customers’ business, the E&S risk management will also dedicate to the sustainable development of the community through mitigating adverse E&S impacts, identifying and promoting investment opportunities and business initiatives that contribute to the environmental protection, natural resource reservation and recovery, biodiversity protection, human health and safety safeguard as well as cultural heritage conservation.

With best efforts, SeABank are consistently implementing the E&S risk management policies to ensure that the Bank’s sustainable operations and contribute to the sustainable development of the community and that the development of today will not jeopardize future generations.

1. Commitment on E&S Risk Management

a) SeABank adopts the following E&S standards in lending activity:

- The Borrowers to comply with applicable Vietnam’s state and local laws and regulations on E&S.

- SeABank denies to finance any clients who is engaged in the Exclusion list issued by SeABank.

b) SeABank incorporates the E&S risk management system into the current process of lending to screen, assess and mitigate E&S risks when appraising and approving credit according to SeABank’s E&S standards and periodically monitor E&S risks during the term of the loan.

c) SeABank is being committed to provide adequate resources and build up sufficient capacity for effective E&S management implementation and continue improving E&S performance of SeABank.

2. Principles of E&S Risk Management

a) E&S risk management policies and procedures are designed to be integrated with SeABank’s current risk policies, procedures and practices.

b) All new credit applications subject to the E&S risk management system will be screened against Exclusion List to ensure that SeABank do not finance any excluded business activities.

c) Renewal/rescheduled/restructured loans arising after effective date of the Regulation on E&S Risk Management System and subject to the E&S Risk Management System must also be screened against Exclusion list.

d) All national environmental, occupational health and safety, and relevant international conventions are applicable to all transactions subject to the E&S risk management system. While carrying out E&S due diligence, all required E&S permits, licenses, and monitoring of E&S parameters are to be considered as mandatory compliance requirements for evaluation of a loan application.

e) International frameworks such as ISO 14001 (environmental management), ISO 45001:2018 (occupational health and safety management), SA45000 (socially acceptable work practices) as well as supply chain environmental and social standards imposed by buyers (e.g., Apple, H&M, Ikea, Nike, Starbucks, Walmart) are considered as best practices and indicative of SeABank’s clients’ commitment to sustainable operations.

f) Adherence to IFC Performance Standards will be considered as good practice in case of large corporate finance and project finance transactions with focus on specific assets.

3. Subject and Scope of Application

a) Governing scope

The E&S risk management regulation applies to the following transaction type of credit at SeABank:

- Individual Customers (exception for personal loans and credit card);

- Trade finance;

- Micro-finance (loan for individual business households/micro-enterprises);

- Small and medium enterprises;

- Green finance (to be loans on which are used for business activities and initiatives in green area according to SeABank’s regulations in the specific time);

- Corporate finance;

- Project finance.

b) Applicable entities

This Environmental and Social Risk Management regulation applies to all relevant units who participate in the credit and post-credit management process at SeABank.

4. E&S Risk Management

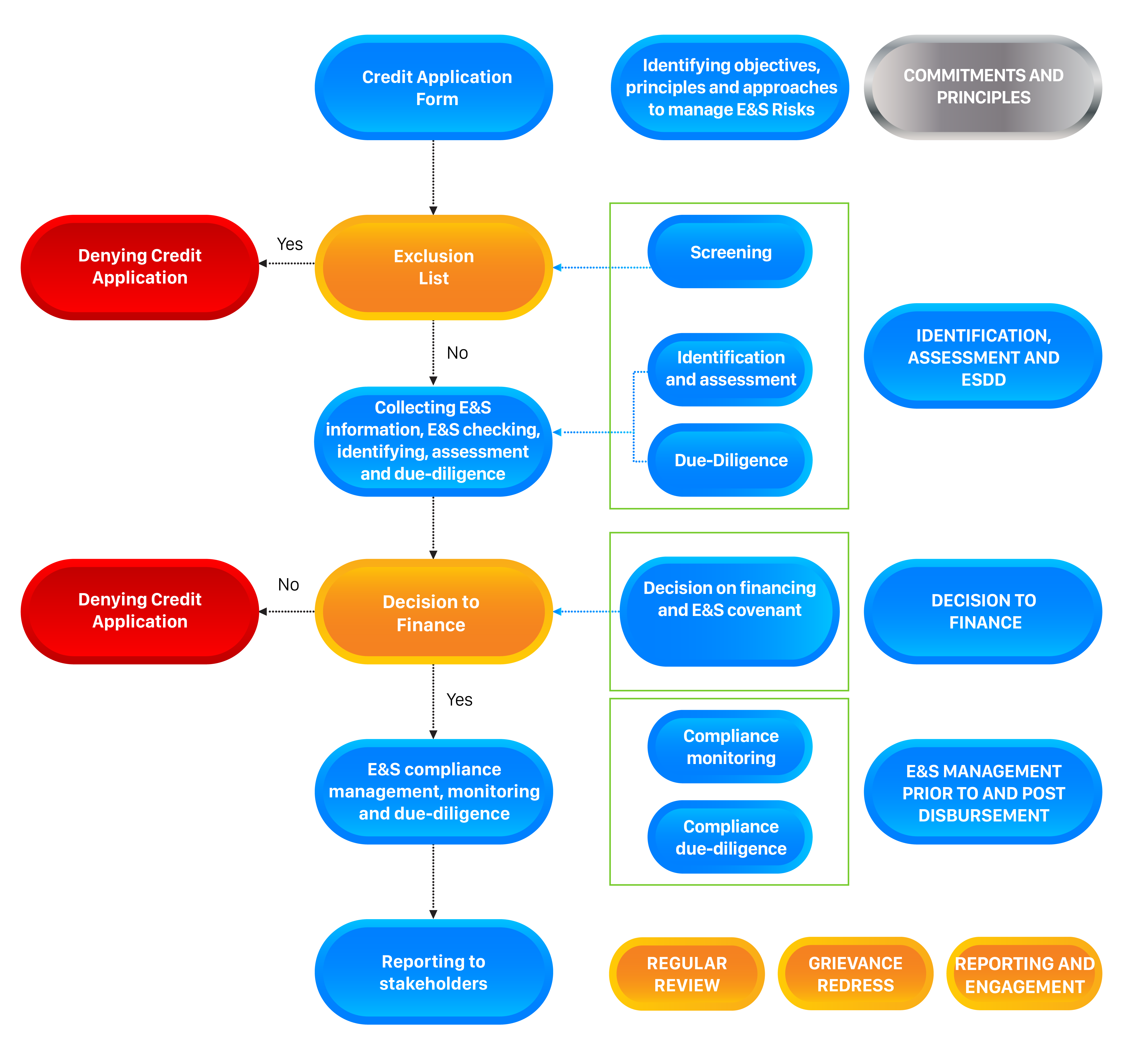

SeABank's implementation of environmental and social risk management will be summarized in the diagram below.

5. Commitments on Transparency, Engagement of Relevant Stakeholders and Reporting

a) Transparency: SeABank considers transparency a key element for sustainable business development. SeABank is committed to disclose to the general public information on social and environmental performance of its operations and require its customers to engage in dialogue with their Stakeholders, identify and interact with potentially affected community (disclose relevant information about the project/business, consult them as appropriate, and ensure their informed participation).

b) Engagement of Stakeholders: Stakeholders include shareholders, customers, communities, authorities, NGOs, SeABank’s staffs, etc., who are related to governing and lending activities of the Bank. SeABank ensures the participation of stakeholders in the management of environmental and social risks by establishing a grievance mechanism by which receive and resolve complaints (if any) related to SeABank's E&S policies and/or projects/ business financed by SeABank via email: contact@seabank.com.vn or hotline: 1900 555 587. SeABank ensures that these opinions will be properly received and handled by relevant departments of the Bank.

c) Reporting mechanism: SeABank will establish a reporting mechanism that includes both internal and external reporting during the implementation of the E&S risk management system, this will ensure that the established E&S Risk Management system will be continuously improved over time. In parallel with that, the information associated with E&S risk management will be provided to interested stakeholders fully and consistently in accordance with the transparency commitment that has been disclosed.

With the objectives of pursuing the core values of "Community Oriented" and "Sustainability", SeABank will apply the E&S Risk Management System in a planned, consistent, transparent, and continuous improvement manner. At the same time, SeABank welcomes the participation of stakeholders in the Bank's E&S risk management activities. We believe that this engagement will guarantee the further promotion of investment opportunities and sustainable business initiatives and contribute to the sustainable development of the community. Finally, SeABank will ensure the disclosure of information related to E&S risk management in accordance with the governing regulations and principles in the Bank's operations.

SeABank plants nearly 671,000 trees in Ha Tinh, surpassing the one-million-tree target

Ha Tinh Province, December 11, 2025 – Southeast Asia Commercial Joint Stock Bank (SeABank, HOSE: SSB) donated 670,800 acacia seedlings to local households in Ky Hoa Commune to support the restoration of forest ecosystems severely damaged by Typhoon Bualoi, while creating sustainable livelihoods for local communities. This initiative brings the total number of trees donated and planted by SeABank to over one million, contributing to reforestation efforts across the country.

23/12/2025

Read more

SeABank honored in Top 10 Best Annual Reports 2025: Affirming transparency and sustainable growth

December 3, 2025, Ho Chi Minh City - At the annual Vietnam Listed Companies Awards 2025 (VLCA), Southeast Asia Commercial Joint Stock Bank (SeABank, HOSE: SSB) was honored in Top 10 Best Annual Reports - Financial Sector, recognizing the Bank’s consistent efforts to enhance corporate governance, transparency, and information disclosure in line with international standards.

12/12/2025

Read more

Two prestigious awards recognize SeABank's efforts to put people first

Southeast Asia Commercial Joint Stock Bank (SeABank, HOSE: SSB) has just been honored with 2 awards for Best Workplaces in Vietnam 2025 (Anphabe) and ESG Business Awards 2025 (ESG Business Magazine - Asian Banking & Finance). This is a double milestone on the Bank's journey to create a happy, equal and empowering working environment for women, in line with the vision of "putting people and communities first" that SeABank has always persistently strived for.

05/12/2025

Read more